Stephanie Choo is a Partner at Portage Ventures.

Co-authored by Andre Masse. Andre is an Investment Associate at Portage Ventures.

Photo from Executium from Unsplash

TL;DR

- When people refer to “decentralized finance” or “DeFi”, they’re talking about the delivery of financial products and services via public blockchains. This is unlike how most financial products and services are delivered today, which is done via traditional profit-seeking intermediaries such as banks.

- The DeFi phenomenon goes way beyond the invention of cryptocurrencies. There is real infrastructure being built that allows users to manage their financial lives based on this brand new system.

- When it comes to regulation, two different approaches have emerged — leverage existing regulatory frameworks (e.g. Canada/US) or build new ones (e.g. Europe)

- Portage’s beliefs about the future of DeFi are:

DeFi is a real paradigm shift

Crypto-native or bust

Tokens are a means to an end

Innovation is cyclical, not sequential and DeFi is no different

Decentralized finance, or DeFi, has the potential to become for financial services what the Internet has been for media production and distribution.

The advent of blockchain has fueled the promises of DeFi. Innovative companies are deploying DeFi technology and capturing billions of dollars in enterprise value. Traditional companies, such as banks and credit card networks, are also experimenting with the technology, which is boosting the credibility of its widespread application in the financial sector.

Those dynamics are leading to an increasing amount of mainstream adoption of DeFi, as well as attention from governments, who are trying to wrap their minds around exactly how to incorporate the new technology into their regulatory architecture.

What is DeFi?

When people refer to “decentralized finance” or “DeFi” today, they’re talking about the delivery of financial products and services via public blockchains. This is unlike how most financial products and services are delivered today, which is done via traditional profit-seeking intermediaries such as banks.

The best-known example of a blockchain network in action is bitcoin.

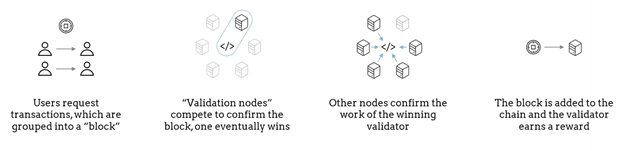

When you buy and sell bitcoin, there is no single/centralized ledger on which the transactions are recorded. There is no central bank, payment network operator, or clearinghouse. Instead, the ledger is distributed among everyone in the decentralized blockchain network, with software run by individuals acting as the main validator rather than financial institutions.

Figure 1. How blockchain transactions work

Blockchain networks come with a number of beneficial features:

- They’re permission-less and trust-less. Anyone can access a blockchain. Because of the distributed, consensus-based approach to verifying what happens on the network, there’s little to no need to restrict people from accessing the network.

- They’re decentralized and resilient. In traditional payment systems, downtime occurs for everyone when the intermediary in the middle goes down. Transactions can’t be executed and all economic activity comes to a halt. When the ledgers are distributed, however, they’re more robust to outages, as no single outage can take down the entire system.

- They’re programmable and transparent. Blockchain networks run on code, which is often open source. Therefore, anyone can see whether the blockchain network will do what it purports to do. Moreover, anyone can access the ledger to see the underlying transaction data.

As a result of these features, the cost and speed of processing transactions and delivering services on blockchain technology can be materially reduced for consumers and businesses. A McKinsey study attributed 70% of the immediate benefits for users of blockchain applications to reduced cost/saving. The financial services sector is rife with opportunities to exploit this cost and speed advantage.

How is DeFi being deployed today?

We believe DeFi has the potential to revolutionize everything from the monetary system to gaming and digital art. While we are still in the early-ish innings of the DeFi movement, we are already starting to see new financial products and services emerge, as we highlight below, but it is clear the most well-known application of DeFi technology to date is in the cryptocurrency space.

The market for cryptocurrency is $1.7 trillion today, with bitcoin accounting for about 40 per cent of that market. Over the past decade, bitcoin has been the best performing asset across all asset classes.

It’s caught the attention of retail investors, who use companies such as our own Wealthsimple to buy and sell cryptocurrencies. Crypto-backed ETFs have also popped up, giving people a way to invest in cryptocurrencies, such as bitcoin and ether, without buying the actual coins.

Institutional investors have also been holding cryptocurrency more and more. Companies are starting to hold it on their balance sheet as part of their treasury strategy to counteract negative yields on cash.

Companies are also increasingly accepting cryptocurrency as a payment instrument, including big brands, such as Coca Cola and Best Buy. The two largest global payment networks — Visa and MasterCard — are also beginning to facilitate cryptocurrency transactions.

Figure 2. Select companies that accept cryptocurrency as payment

But, as noted above, the DeFi phenomenon goes way beyond cryptocurrencies. There is real infrastructure being built that allows users to manage their financial lives based on this brand new system, which is what we are most excited about.

If you want to see what a ‘traditional’ financial services company built entirely using DeFi technology looks like, look no further than Figure. Built on top of the Provenance blockchain, Figure uses blockchain technology for products including home lending, capital table management, fund management and administration, banking, and payments. In May, Figure closed a $200M USD Series D at a $3.2B valuation.

One area that we are particularly excited about the potential for DeFi to disrupt is the lending and borrowing markets. For instance, a protocol such as Compound leverages DeFi to create a peer-to-peer marketplace to match lenders and borrowers in real-time. Meanwhile, Teller’s distributed cloud network leverages user data to build a decentralized credit-decisioning engine.

The creator and gaming economies are also seeing DeFi uptake. Rally uses the Ethereum blockchain network to enable creators to launch independent economies and release tokens to earn revenue and engage with their fans. ZED.RUN is a decentralized horse-racing game that provides gamers with the ability to trade virtual horses, which compete in races to win crypto-based prize pools.

These are just a handful of examples of how companies are leveraging blockchain technology to deliver superior value to their users. As adoption continues to further penetrate the mainstream, it is our belief that there is a significant opportunity to build trusted brands acting as a gateway to this increasingly decentralized and digital world.

What are governments doing about it?

Regulating DeFi is challenging. Because DeFi leverages a distributed network and eliminates the need for middlemen, there is no central party coordinating it all for governments to regulate.

Instead, regulators are turning their attention to the companies acting as gateways into the world of DeFi.

When it comes to regulation, two different approaches have emerged. In Canada and the United States, existing regulatory frameworks are being applied to new assets and new markets. In Europe, some countries have established new and specific crypto-asset regulations. Not surprisingly, much of the regulatory focus to date has been on cryptocurrencies.

As an example, in Canada, crypto-based EFTs are regulated under the same framework as other investment funds. Moreover, some dealers of cryptocurrency are being required to register with provincial securities regulators. The rationale is that if cryptocurrency is not “immediately delivered” in a crypto-exchange, then what’s being exchanged is a “right” to cryptocurrency, which regulators are classifying as a security or derivative.

In the United States, regulation varies state by state. Some states have established cryptocurrency custodian licenses, such as New York, which requires that cryptocurrency businesses obtain a “BitLicense.” Cryptocurrency exchanges are also considered money service businesses, which requires them to comply with anti-money laundering legislation. While there is no federal crypto-asset regulation in the United States, the chair of the United States Securities and Exchange Commission, Gary Gensler, has said crypto-asset regulation may be necessary.

In Europe, providers of DeFi products and services need to register at the national level to comply with anti-money laundering legislation. Moreover, some countries, such as Germany and Switzerland, have regulation and registration regimes specifically for crypto-platforms and custodians. The European Union has also proposed crypto-asset regulation. The Markets in Crypto Assets Regulation covers crypto-based marketplaces, dealers, and custodians. Under the proposed regulation, token offerings will require approval before being listed on exchanges.

Another common regulatory intervention across jurisdictions is central bank digital currencies, or CBDCs. Eighty percent of central banks around the world are exploring whether to issue their own CBDC and how they could do it.

A CBDC is a central bank’s answer to the ever-increasing crypto-based threat to its monetary sovereignty. A direct claim on a central bank, CBDCs are like fiat currencies, but they come with additional benefits. For example, they make payment systems and the administration of monetary policy more efficient.

DeFi is here to stay, so what’s next?

Portage’s beliefs about the future of DeFi are:

- DeFi is a real paradigm shift. Innovation is creating opportunities to do things with blockchain networks that were once uneconomical to do. For instance, it is now possible to offer credit products to the unbanked population via Compound or to leverage digital assets as collateral to access secured loans via Maker.

- Crypto-native or bust. Applications that merely try to replicate use cases that work well in the centralized world and bring them over to DeFi are not where we see most of the value accruing over time.

- Tokens are a means to an end. The volatility of cryptocurrency distracts many people from the highly valuable blockchain-based infrastructure being built, with sound applications in financial services and beyond. As for traditional financial services, currency is critically important, but tangible economic value is delivered via the applications that leverage this currency.

- Innovation is cyclical, not sequential. Infrastructure requirements need a tangible set of use cases to be properly defined. As such, it is misleading to think of applications as the result of infrastructure improvements. Just like the airplane (application) was invented before airports (infrastructure), Bitcoin (application) informed the development of Ethereum (infrastructure), which gave rise to new applications that are themselves creating new infrastructure opportunities.

At Portage Ventures, we aim to invest in and build the world’s most innovative financial technology companies from early-stage to growth and beyond. We believe DeFi technology will play an increasingly important role in helping us meet that objective.